| Bitcoin Production and Operations Updates for July 2024 | |||||||||

| Comparison (%) | |||||||||

| Metric | July 2024 1 | June 2024 1 | July 2023 | Month/Month | Year/Year | ||||

| Bitcoin Produced | 370 | 255 | 410 | 45 % | -10 % | ||||

| Average Bitcoin Produced per Day | 11.9 | 8.5 | 13.2 | 40 % | -10 % | ||||

| Bitcoin Held 2 | 9,704 | 9,334 | 7,275 | 4 % | 33 % | ||||

| Bitcoin Sold | – | – | 400 | N/A | N/A | ||||

| Bitcoin Sales – Net Proceeds | – | – | $12.1 million | N/A | N/A | ||||

| Average Net Price per Bitcoin Sold | N/A | N/A | $30,293 | N/A | N/A | ||||

| Deployed Hash Rate – Rockdale 2 | 14.7 EH/s | 14.7 EH/s | 10.7 EH/s | 0 % | 37 % | ||||

| Deployed Hash Rate – Corsicana 2 | 7.6 EH/s | 7.3 EH/s | – | 4 % | N/A | ||||

| Deployed Hash Rate – Kentucky 2,3 | 1.0 EH/s | N/A | N/A | N/A | N/A | ||||

| Deployed Hash Rate – Total 2 | 23.3 EH/s | 22.0 EH/s | 10.7 EH/s | 6 % | 118 % | ||||

| Avg. Operating Hash Rate – Rockdale 4 | 9.6 EH/s | 7.7 EH/s | 5.4 EH/s | 24 % | 78 % | ||||

| Avg. Operating Hash Rate – Corsicana 4 | 5.7 EH/s | 3.6 EH/s | – | 57 % | N/A | ||||

| Avg. Operating Hash Rate – Kentucky 3,5 | 0.9 EH/s | N/A | N/A | N/A | N/A | ||||

| Avg. Operating Hash Rate – Total 4 | 15.5 EH/s | 11.4 EH/s | 5.4 EH/s | 37 % | 188 % | ||||

| Power Credits 6 | $3.2 million | $4.7 million | $6.0 million | -32 % | -47 % | ||||

| Demand Response Credits 7 | $0.2 million | $0.5 million | $1.8 million | -59 % | -89 % | ||||

| Total Power Credits | $3.4 million | $5.2 million | $7.8 million | -35 % | -57 % | ||||

| All-in Power Cost – Rockdale 8 | 3.0c/kWh | 2.4c/kWh | 1.6c/kWh | 26 % | 79 % | ||||

| All-in Power Cost – Corsicana 8 | 3.9c/kWh | 3.7c/kWh | N/A | 5 % | N/A | ||||

| All-in Power Cost – Kentucky 8,9 | 3.6c/kWh | N/A | N/A | N/A | N/A | ||||

| All-in Power Cost – Total 8 | 3.4c/kWh | 2.6c/kWh | 1.6c/kWh | 33 % | 109 % | ||||

| 1. | Unaudited, estimated. | ||||||||

| 2. | As of month-end. | ||||||||

| 3. | Includes self-mining capacity hosted outside of Kentucky. | ||||||||

| 4. | Average over the month. | ||||||||

| 5. | Average from July 24 to 31, where Riot held 100% ownership of the Kentucky assets. | ||||||||

| 6. | Estimated power curtailment credits. | ||||||||

| 7. | Estimated credits received from participation in ERCOT and MISO demand response programs. | ||||||||

| 8. | Estimated. Inclusive of all transmission and distribution charges, fees, adders, and taxes. Net of Total Power Credits. | ||||||||

| 9. | All-in power cost from July 24 to 31, for Kentucky assets. | ||||||||

Hosting

Riot Announces July 2024 Production and Operations Updates

Riot Platforms, Inc. (NASDAQ: RIOT) (“Riot” or “the Company”), an industry leader in vertically integrated Bitcoin (“BTC”) mining, announces unaudited production and operations updates for July 2024.

“July was a major step forward for Riot, as we increased our Bitcoin production 45% over June and completed a new acquisition, expanding our operations into a new market,”

- Jason Les, CEO of Riot.

“Riot mined 370 Bitcoin during July, a significant month-over-month increase, demonstrating improved results from the significant deployment of hash rate at our Corsicana Facility at the end of June. We are seeing strong performance from the immersion systems and MicroBT miners at our Corsicana Facility, and expect results to further improve as the commissioning process completes and all cooling systems become fully operational. Combined with ongoing improvements at our Rockdale Facility, we remain on path to significantly enhance operating uptime as the year progresses.

“During July, Riot also announced the acquisition of Block Mining, a vertically-integrated private miner operating in Kentucky. From this acquisition, Riot immediately added 1 EH of self-mining capacity and will begin to add additional hash rate based on already available capacity at the newly acquired Kentucky facilities. Work to expand into the power capacity available is underway, and we anticipate reaching 5 EH/s of hash rate capacity in Kentucky by the end of this year.”

Riot’s Power Strategy Overview

Riot’s power strategy is based on being a flexible consumer of power. The Company typically consumes power when it is low-cost and abundant, as opposed to residential consumers, who typically increase power usage during peak periods of demand. When demand increases and/or supply decreases, causing prices to rise, the Company can either power down to reduce power costs, or bid competitively to provide the grid operator with visibility into, and control over, Riot’s power utilization. This control gives the grid operator the ability to either absorb excess power when supply is high or to curtail Riot’s operations in order to reduce demand when beneficial to the grid, and ultimately, to all consumers.

During July, Riot continued its participation in ERCOT’s Four Coincident Peak Program (“4CP”). The 4CP program is an opportunity for users of power to curtail usage during periods of highest demand on the grid in each of the four summer months of the year. Riot curtailed operations in July during peak periods of demand within ERCOT and will continue to do so throughout the summer. These periods of curtailment occur whenever total demand on the grid could reach its peak point for each month and does not depend on the current price for power, which fluctuates due to a variety of factors and may be lower or higher than anticipated. As part of Riot’s participation in this voluntary program, the Company can achieve substantial savings on future costs, and participation is a key part of the Company’s partnership-driven approach with the grid and all consumers of power in ERCOT.

Infrastructure Update

Riot is currently developing Phase 1 of the Company’s second large-scale facility, the Corsicana Facility, which is expected to total 400 megawatts (“MW”) of developed mining capacity upon completion of this initial phase. Once fully developed, the Corsicana Facility is expected to total 1 gigawatt (1,000 MWs) in total developed mining capacity.

Buildings A1 and A2 are fully energized and operational, while deployment and energization continues in Building B1. Building B2 is currently under construction and miner deployment is expected to begin in September.

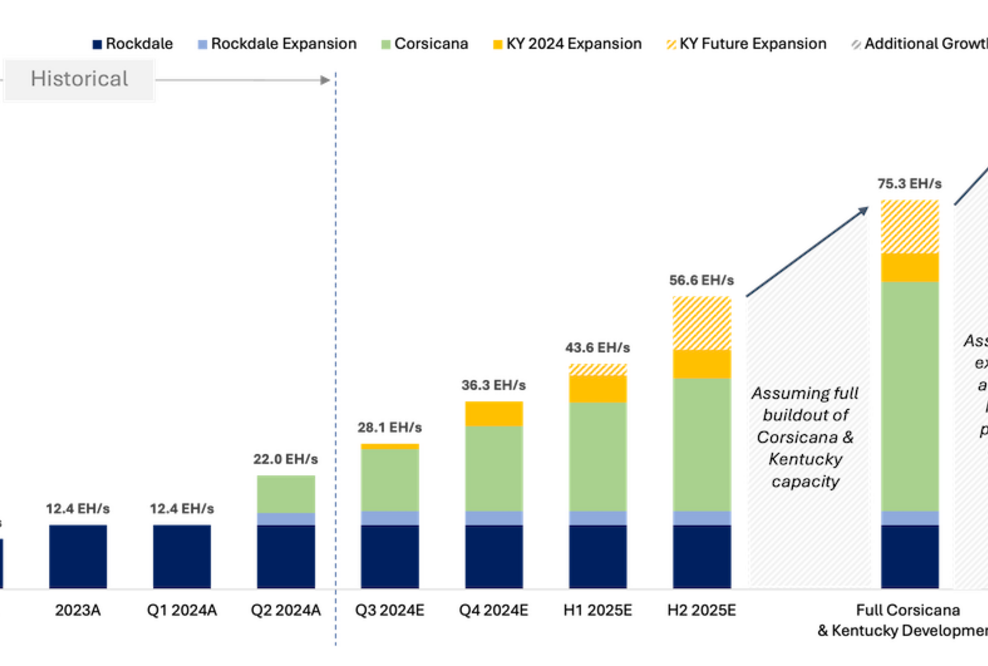

Riot anticipates achieving a total self-mining hash rate capacity of 36 EH/s by the end of 2024.

On April 18th, Riot announced the successful energization of the Corsicana Facility substation. The Corsicana Facility will have a total capacity of 1 GW when fully developed, at which point it is expected to be the largest known Bitcoin mining facility in the world by developed capacity. The recently energized substation will power the initial 400 MW phase of development of the Corsicana Facility. This initial phase is expected to add 16 EH/s to Riot’s self-mining capacity by the end of 2024.

On July 23rd, Riot announced the acquisition of Block Mining. The transaction immediately increases Riot’s hash rate by 1 EH/s and establishes an additional arm of growth for Riot in new jurisdictions and energy markets, starting in Kentucky. The acquisition includes 60 MW of existing operational capacity with potential to expand to over 300 MW in total in Kentucky. Riot’s immediate focus will be on integrating Block Mining’s operations and team into Riot and providing support towards near-term expansion opportunities.

Following the Block Mining acquisition, Riot raised its 2024 deployed hash rate guidance from 31 EH/s to 36 EH/s, and upon full deployment in 2025, Riot now anticipates a total self-mining hash rate capacity of 56 EH/s.

Riot Platforms beabsichtigt, das Blockchain-Ökosystem durch seine Kryptowährungs-Mining-Aktivitäten, intern entwickelte Unternehmen und Joint Ventures zu erschließen. Sein Hauptaugenmerk liegt auf Bitcoin und der allgemeinen Blockchain-Technologie.

Our mission is to positively impact the sectors, networks and communities that we touch. We believe that the combination of an innovative spirit and strong community partnership allows the Company to achieve best-in-class execution and create successful outcomes.

Riot Platforms is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. The Company has Bitcoin mining data center operations in central Texas, Bitcoin mining operations in central Texas, and electrical switchgear engineering and fabrication operations in Denver, Colorado.